Why Kenya Is One of the Hottest iGaming GEOs Right Now

- Kenya: A Prime Market for iGaming Affiliates

- Local Snapshot: What You Need to Know

- Key iGaming Growth Trends in Kenya

- Regulatory and Legal Landscape

- Consumer Behavior & Incentives

- Mobile and Payment Ecosystem

- Effective Affiliate Marketing Channels & Strategies

- Top Traffic Sources for Kenya

- Creatives for the Kenyan Market

- Actionable Tips for Affiliates in Kenya

- 888STARZ Partners: Choosing Best Affiliate Program

Kenya has quietly become one of the most promising markets for iGaming affiliates. With millions of sports fans, a strong betting culture, and mobile payments like M-Pesa that players trust, it’s a GEO where even small budgets can bring solid results. Competition is still low, traffic costs are reasonable, and players are ready to deposit and play. For affiliates looking to tap into a market with huge potential and low entry barriers, Kenya is the right move — and the right time is now. The 888STARZ Partners team is ready to help you make the most of this opportunity — find out more today!

Kenya: A Prime Market for iGaming Affiliates

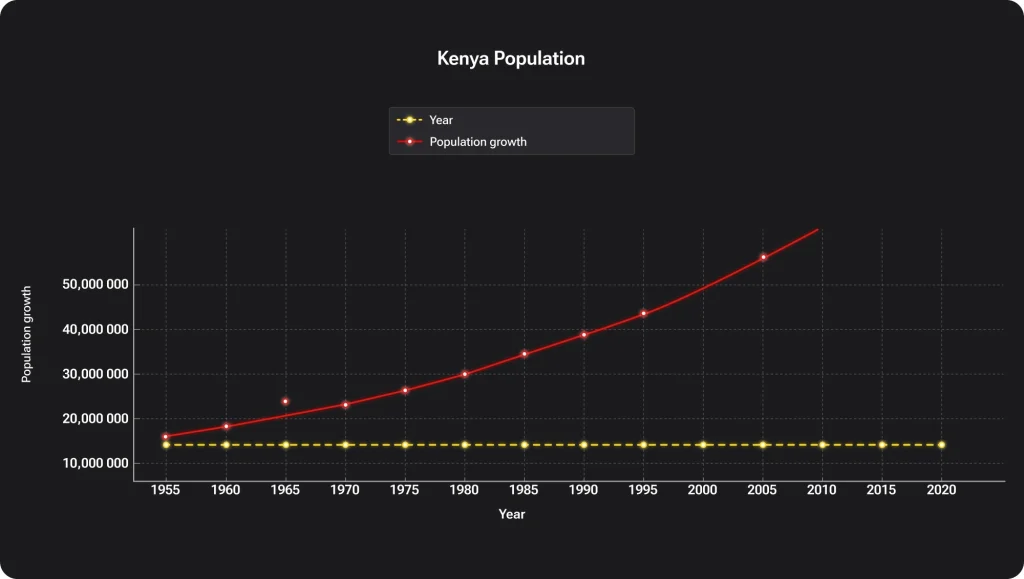

The Republic of Kenya is a Tier-3 country located in East Africa. This GEO has emerged as one of Africa’s fastest-growing iGaming markets. According to Worldometers’ data, the country’s ~57.5 million people (in mid-2025) are very young (median age ~20) and increasingly connected. The Communications Authority of Kenya recent research predicts that over 80% of Kenyans will own a smartphone by 2025 (42.3M devices, ~80.8% penetration), and internet access is rising (currently ~40.8%, projected ~65% by 2025).

Kenya has ~122 mobile subscriptions per 100 people and 76.2M active SIMs (it’s 145% penetration). This mobile-first population and growing middle class are fueling a booming online betting and casino sector. In fact, Kenya is ranked third in Sub‑Saharan Africa for gambling market size (behind only South Africa and Nigeria), with total gambling revenue projected to reach about $831 million by 2025 (Slotegrators’ research).

Formerly a British colony, Kenya gained independence in 1963 and subsequently experienced prolonged internal conflicts that lasted until 2009. However, unlike neighboring Somalia and South Sudan, Kenya managed to recover quickly and has since become a key trade hub in East Africa. The country’s GDP reached $131.6 billion in 2025, up from $101.1 billion in 2020. As a result, average monthly income in Kenya is relatively high compared to its neighbors, ranging from $300 to $400.

Kenya’s core gaming demographic is young and male. Most avid bettors are men aged 18–35, often living in urban areas. These users overwhelmingly prefer mobile play: as of 2019 about 88% of Kenyan gamblers were betting on smartphones, and smartphone adoption has only increased since. Affiliates should therefore optimize all sites and ads for mobile screens. Content tastes skew strongly toward sports and competition — football is by far the favorite (English Premier League, UEFA Champions League, La Liga, plus the local Kenyan Premier League). Other popular betting genres include rugby, basketball, cricket and boxing.

Casino gaming is also widely embraced: land-based casinos (e.g. Casino Flamingo, Senator Casino) draw city crowds, and their online branches (slots, blackjack, roulette, live-dealer poker) are quickly expanding. Notably, Kenya leads the continent in the frequency of play — roughly 37% of bettors wager weekly and about 16% bet multiple times per day.

The profile of Kenyan players has important implications for affiliate marketing. They respond to localized, culturally relevant content. Using Swahili and “Kenyan English”, sports slang and team symbols in ads boosts credibility. Kenyan bettors trust recommendations from real people: local influencers and bloggers often convert better than big brand ads. Affiliates should highlight popular leagues and teams in ad campaigns, and emphasize community — according to the iGB Affiliate data, for Kenyans “betting is a social thing”. Offering straightforward bonuses (free spins, deposit matches or bonus credits) is also very effective (Kenyan punters explicitly prefer localized bonuses tied to mobile-money like M-Pesa). In summary, a Kenyan player is typically a young mobile user who loves football and values simple, trust-building content and offers for iGaming.

Important: 888STARZ Partners products have recently obtained an official operator license in Kenya. This means our partners can now confidently run advertising campaigns in this region. All the key information on the latest news is provided right here. And for our top-performing partners, we offer custom deals and access to exclusive offers in various GEOs.

Local Snapshot: What You Need to Know

If you’re planning to work with the gambling market in Africa, especially Kenya, it helps to understand the basics. What language do people speak? What currency do they use? How open are they to gambling? This section gives you a quick overview of the everyday reality in Kenya — from a fast-growing iGaming scene and strong mobile devices usage to a culture that’s generally welcoming to betting. It’s the kind of context that makes all the difference when you’re trying to connect with the right audience.

Language

Kenya has two official languages — English and Swahili. The younger population, especially in urban areas, is typically fluent in both. In rural regions, particularly remote areas, Swahili is more commonly spoken.

Currency

The official currency is the Kenyan Shilling (KES), which in 2025 is valued at around 129 KES per $1. In coastal port cities like Mombasa, as well as tourist hubs such as Malindi, Lamu, and Nairobi (popular for safari tours) the US dollar and euro are also widely used.

Audience

Kenya stands out as one of Africa’s most dynamic iGaming hubs, attracting both local players and international visitors. The industry is well-established, with over 30 licensed casinos and a dense network of betting outlets, particularly in major urban centers like Nairobi and Mombasa. Projections indicate the Kenyan gambling sector is on track to surpass $800 million by 2025.

Religious opposition to gambling is minimal. The majority of Kenyans (more than 80%) identify as Christian, while Muslims make up roughly 17%, and a small minority follow traditional belief systems. This diverse yet generally tolerant religious landscape allows gambling to flourish without major cultural resistance. The rise of digital infrastructure has also fueled iGaming growth. With over 40% of the population having internet access, mobile betting and online casinos have become more accessible than ever before.

Data from GeoPoll reveals just how embedded gambling is in everyday life: 37% of Kenyans bet weekly, 28.5% monthly, 18% every day, and 15.8% multiple times a day. Unsurprisingly, football dominates as the preferred sport among bettors.

Key iGaming Growth Trends in Kenya

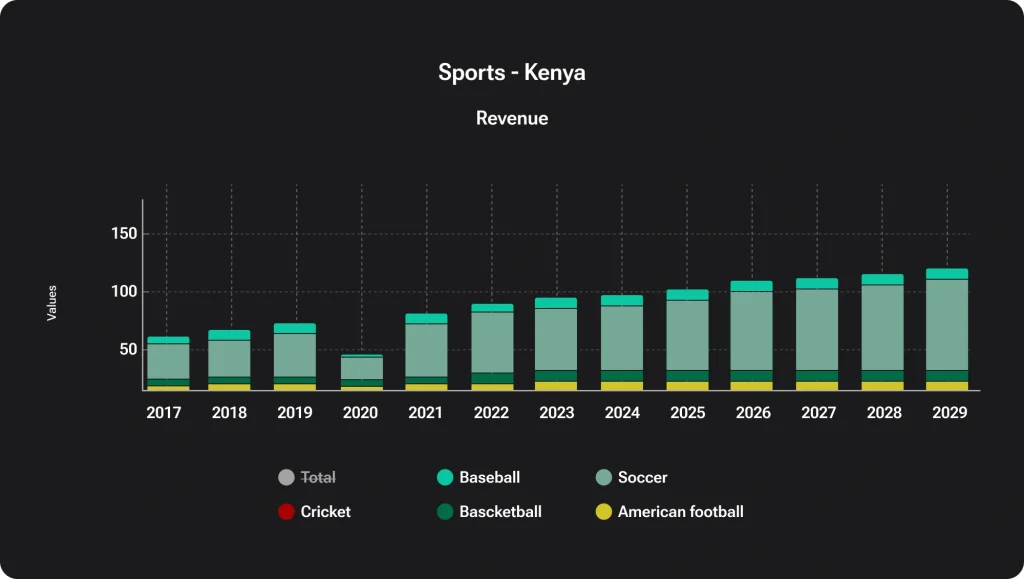

Kenya offers excellent opportunities for promoting iGaming offers thanks to low traffic costs and minimal competition. Both sports betting and casino gaming are rapidly growing in this GEO. Industry forecasts project millions of Kenyan online gamblers by 2029 — for example, Statista estimates ~2 million casino players and nearly 0.5 million sports bettors. Growth is driven by the mobile leapfrog: extensive 4G/5G rollouts and affordable data have made gambling apps ubiquitous. By early 2025 Kenya’s smartphone penetration hit ~80.8% and mobile money accounts ~86.6%, enabling on-the-go betting. In practice, about 37% of Kenyan bettors wager weekly — the highest play rates in Africa.

Several trends stand out for 2025. First, innovative formats are gaining popularity. In addition to classic sportsbook bets, more players are trying virtual sports, fast crash games, and e-sports tournaments. For example, Kenyans under 35 rank #2 in Africa for cryptocurrency use, and crypto-based betting is growing fast.

Second, new operators and licenses are expanding choice: from SportPesa’s 2013 launch to now ~128 licensed betting firms, competition is intense. Consumers benefit from sophisticated apps and promotions as companies chase market share. Third, big sporting events continue to fuel activity. Football and athletics tournaments (e.g. Kenyan Premier League, African Cup qualifiers, Olympics) generate betting peaks. Affiliates should time campaigns around such events. Finally, digital marketing innovation is on the rise — Kenyan gamers are heavy social media users, so live updates, interactive streams and social promotions are catching on.

If you’re serious about generating football traffic in East Africa, don’t miss our in‑depth review at how TikTok and Instagram influencers in Kenya are monetizing their audiences through iGaming. Read the full article here →

Regulatory and Legal Landscape

Online gambling is legal in Kenya, but heavily regulated — especially when it comes to advertising. From April 2025, all gambling-related ads, including social media posts, must get approval from both the Betting Control and Licensing Board (BCLB) and the Kenya Film Classification Board. Every promo needs to display the operator’s license number and carry a responsible gambling message.

Earlier that year, authorities paused all gambling promos for 30 days, signalling a shift toward tighter enforcement. For affiliates, this means you can’t just launch campaigns without double-checking local rules. Ads that don’t follow the guidelines risk takedowns or worse.

Crucially, promoters cannot use “bet right now” or other direct inducements (according to AffPapa data). All ad copy that glamorizes gambling or uses celebrity endorsements is disallowed. Meta and Google still technically allow gaming ads if approved, but affiliates often find better success via alternative channels (native ad networks and push/pop campaigns). Affiliates should therefore avoid overt calls-to-action and instead focus on educational or brand-building content.

However, running ads in Kenya is still possible — provided that specific requirements are met:

- The ad must include the warning: “Gambling is addictive. Play responsibly!”.

- It should display the operator’s BCLB license number.

- It must be clearly marked with an 18+ age restriction.

When setting up campaigns on Google or Facebook, ensure your targeting is strictly limited to users aged 18 and above. Be sure to include all required warnings and notices in your ad creatives to avoid account suspension or ad rejection.

To summarize regulation: iGaming is legal if licensed, but Kenya now has zero tolerance for hard-sell gambling ads. Affiliates must stay compliant by following BCLB guidelines (e.g. approved messaging, age limits) and pivot toward indirect promotion (branding, content marketing). Many affiliate experts advise leaning on community engagement and responsible messaging to align with the rules.

Consumer Behavior & Incentives

Kenyan iGamers seek fun and value. They overwhelmingly bet on European soccer, so content that highlights Premier League or national team matches performs very well. Live betting (during matches) is especially popular. Affiliates who publish match previews, betting tips, and score trackers can tap into this demand. Content preferences tend toward practical guides and analysis: Kenyan bettors appreciate educational articles and tutorials on how to wager wisely. One strategy is to create how-to-win or odds-explainer videos rather than spam “click here” ads. Influencer partners and local sports bloggers are effective channels because users trust peer advice.

Promotions and bonuses drive conversions. Kenyan players love clear, straightforward offers — for example, deposit-match bonuses, free bets or spins, and cashback offers with no confusing fine print. Locally tailored incentives work best: Kenyans prefer bonuses that tie into local practices (e.g. extra credits when depositing via M-Pesa or Airtel Money). Affiliates should highlight such incentives prominently in ads and landing pages. It’s also wise to emphasize safe play: warnings about age limits or links to responsible gaming pages can increase trust among wary consumers.

Typical consumer searches illustrate these behaviors. Many users Google phrases like “top gaming sites in Kenya” or “best bonuses for Kenyan bettors”. High-volume searches include “online betting Kenya”, as well as brand-specific queries (e.g. “888STARZ bonus code”). Affiliates should target these local keywords in blog posts and SEO campaigns. Overall, Kenyans react positively to transparent content (bonus lists, site comparisons, winner testimonials), and negatively to aggressive sales tactics.

Mobile and Payment Ecosystem

Kenya’s mobile and fintech environment is extremely favorable for iGaming. By Q1 2025 Kenya had 76.2 million active SIMs (145.3% penetration), reflecting ubiquitous phone use. Mobile-money is pervasive: there were 45.4 million mobile money subscriptions (roughly 86.6% of the population) in early 2025. Safaricom’s M-Pesa remains dominant (about 90.8% market share), while Airtel Money is growing (now ~9.1%). E-wallets like Skrill or Neteller have some traction, and crypto is emerging as an option for tech-savvy users.

In Kenya, users prefer M-Pesa for deposits — it’s fast, trusted, and widely used. Affiliates should focus on promoting offers that support M-Pesa or similar mobile payments like Airtel Money. Sites without local payment options tend to convert worse. Notably, at 888STARZ Partners we accept local currencies and payout via M-Pesa or crypto, streamlining conversions.

Kenya has strong 4G coverage and growing 5G access, even in rural areas — most users bet from their phones. Affiliates should keep pages lightweight and mobile-friendly to avoid slow loads on variable connections. With over 45 million mobile wallets, it’s a mobile-driven market — and that’s exactly where conversions happen.

To help with mobile traffic, 888STARZ Partners provides ready-to-run PWA & WebView apps tailored for fast, seamless installs — ideal for mobile-focused campaigns.

Effective Affiliate Marketing Channels & Strategies

Kenya is a unique region that requires a tailored approach when launching ad campaigns. To successfully convert traffic here, marketers must consider several geographic and cultural factors and adjust their strategy accordingly. First things first, it includes such factors as:

Targeting

The average age in Kenya is 20–21 years. Young people are highly active online and frequently place bets via their smartphones. While most of the engaged audience lives in urban areas, satellite internet has also brought rural users into the mix, though to a lesser extent.

Locals primarily use platforms like Facebook, WhatsApp, and YouTube — just like in many other regions. It’s most effective to target users with flexible work schedules. For example, outside the tourist season, local motorcycle taxi drivers (known as boda-boda) often place sports bets to pass the time and enjoy the thrill.

Affiliates, who want to work with Kenyan market, also should employ a multi-channel approach:

Mobile-First Paid Traffic

Native ads and push/pop campaigns dominate the Kenyan market. Popunder ads are particularly effective (they rank as #1 traffic source in Africa). Interstitial and In-Page Push ads (large mobile-friendly formats) also generate high engagement. Use targeting by device/carrier and geo to hone in on Kenyan Android users. CPM campaigns can be safer for testing offers (Adsterra recommends CPM before switching to CPA). In short, leverage native ad networks to reach Kenyan gamers (millions of Kenyans engage on Facebook/Instagram, which drive heavy traffic).

While Kenya is often seen as a low-entry-barrier market thanks to its mobile-first audience and strong demand for betting, affiliates should be aware that running ad campaigns on platforms like Facebook and Google can be challenging. Due to regulatory requirements, getting accounts verified and compliant may involve extra steps, including stricter documentation checks. Plan ahead for account setup and consider alternative channels like influencer partnerships, Telegram, or WhatsApp groups to diversify your traffic sources.

SEO & Content

Building an optimized website or blog can pay off long-term. Create content in English and Swahili that targets Kenyan search terms (e.g. “kenya betting apps”, “free spins Kenya”). Include local phrases and team names to improve relevance. Use keyword research to find SEO queries like “games with big bonuses Kenya” or “how to bet in Kenya” and write helpful guides on those topics. Over time, ranking for niche terms (even low-volume) can bring targeted traffic of engaged players.

Social Media & Influencer Marketing

Kenyans are highly social online. TikTok, Instagram and YouTube influencers (especially sports personalities or gamers) can build trust. Some affiliates that actively work in this GEO note that Kenyans “associate with real people, not faceless brands”, so a local influencer or even micro-influencer can deliver strong conversions. Short video content (match highlights with affiliate link in description, for example) works well. Telegram and WhatsApp channels (where allowed) can also spread tips and affiliate links organically.

Other Specialty Channels

Finally, don’t overlook smaller channels. Gaming forums, newsletters, and sports apps popular in East Africa can be useful. Some affiliates create WhatsApp tipster groups. Email marketing can work for retention (sending bonus alerts, for example) but be careful about spam laws. Also, mobile app install campaigns can be lucrative: promote betting apps directly (with Google/Apple certification if needed) since app users deposit faster than web-only signups.

Looking to scale iGaming campaigns in Kenya? Discover how top affiliates structure creatives and funnels to stay compliant and profitable. Read the full strategy breakdown →

Top Traffic Sources for Kenya

Let’s take a look at the most effective traffic sources for promoting offers in Kenya.

TikTok

Despite government attempts to ban TikTok in 2024 due to illegal content from neighboring Somalia and Sudan, the platform remains highly popular. Around 54% of Kenyans actively use TikTok, following local creators and influencers from across East Africa. That’s why iGaming promotions perform best when integrated natively through local TikTok influencers, especially those focused on sports commentary or betting tips. Partnering with trusted voices in the community is the key to successful engagement.

YouTube

YouTube is slightly less popular than TikTok in Kenya, with a reach of 23.3% of the population. However, it still hosts a wide range of local creators followed by both younger and older generations. Focus on betting influencers who review major football tournaments in Swahili or English, and consider collaborating with them for long-form content or promo integrations.

Once used by over 63% of the population, Facebook saw a decline after the 2024 protests against the #RejectFinanceBill2024 and #RutoMustGo campaigns, during which authorities attempted to restrict the platform. In 2025, around 35–45% of Kenyans will still use Facebook. Despite the drop, promoting offers via niche betting communities or posing as iGaming influencers remains a viable strategy. Plus, running legal ad campaigns is still possible and often effective.

Twitter (X)

X is a rising source of betting traffic in Kenya. Many top influencers there have highly active followings and loyal audiences. Promotions often generate lively engagement, and traffic is frequently redirected into Telegram channels — making X a strong entry point for lead generation.

Telegram

Telegram is widely used by local tipsters and betting groups. Once users land here from TikTok or X, they often stay engaged — especially when content is localized and tied to real personalities or expert voices.

This is the most popular messenger in Kenya. For performance marketing, consider buying ad placements in private groups, which are widespread across the African countries. For such GEOs you can also send paid betting tips via text or even voice broadcasts in Swahili — a unique format that works especially well. Look for local tipster channels and partner with them for direct engagement.

Creatives for the Kenyan Market

One notable nuance is how locals refer to themselves — rather than calling themselves Kenyans, many identify with the indigenous group known as the Maasai. The Maasai are seen as strong in body and spirit, making this reference a powerful tool for betting creatives, especially those featuring local football stars like Aboud Hamisi or Michael Olunga.

Local imagery and themes also matter. Kenya is mostly made up of savannah landscapes, so typical “African-style” visuals with deserts and pharaohs won’t resonate here. Instead, consider using images of Kenya’s National Parks. The country also borders the Indian Ocean and has mountain plateaus reaching up to 5,200 meters, which can inspire video ads built around messages like “Bet anytime, anywhere” or “Pay for your next family holiday”.

There are several national holidays in Kenya that you can align your campaigns with. These include a mix of Christian, Islamic, and uniquely Kenyan celebrations:

- June 1 – Madaraka Day (Independence Day).

- October 10 – Mazingira Day (Environmental Day).

- October 20 – Heroes Day (Honoring independence fighters).

- December 12 – Jamhuri Day (Republic Day).

Make sure to adapt your promotions to these holidays — highlighting deposit bonuses or free spins is a great way to engage users during these periods.

Finally, remember that smartphones are the primary gateway to the internet in Kenya. All ad creatives must be optimized for mobile. Also, always reference local payment systems in your messaging — especially M-Pesa, as well as mobile carriers like MTN, Airtel Tigo, and Vodafone.

If you want to start promoting licensed operators in Kenya, sign up with 888STARZ Partners. With us, you can legally run betting and gambling traffic in over 100 Tier-1, Tier-2, and Tier-3 countries — all while earning some of the highest rates on the market. No need to worry about creatives: our in-house team will deliver fully localized promo materials tailored for GEO Kenya — absolutely free!

Actionable Tips for Affiliates in Kenya

Finally, let’s name some key recommendations for those affiliates in iGaming, who are currently working or planning to do it in near future:

- Go Mobile-First. Always target mobile users. Use mobile-friendly ad formats and landing pages. Split-test campaigns with mobile-only vs desktop, but bet big on Android. Ensure fast page load on 3G/4G.

- Localize Everything. Tailor your content to Kenyan tastes: language, tone and imagery. Incorporate Swahili phrases, local team colors/mascots, and references to Kenyan culture. Even small touches (e.g. mentioning M-Pesa) signal relevance.

- Align with Football. Schedule campaigns around major soccer events, local derby matches, or international tournaments. Use match previews, stats, and promotions tied to these events. Football-themed creatives grab attention more than generic gambling ads.

- Use High-Engagement Ad Formats. In Kenya, popunder and interstitial ads pull in traffic well. Leverage push notifications and in-page push for re-engagement. Complement with social-proof banners (testimonials, big-win graphics) to boost CTR.

- Offer Clear Incentives. Highlight welcome bonuses, free bets or free spins prominently. Keep bonus terms simple (no confusing wagering requirements). Kenyan players value easy gains, so emphasize “100% bonus” or “free bet” rather than complicated deals.

- Optimize SEO & Content. Publish blog posts or YouTube videos on “how to play” guides and listicles (e.g. “5 Best Betting Apps in Kenya”). Target local long-tail keywords. Over time, organic traffic from Google and YouTube will lower your costs.

- Leverage Influencers. Collaborate with Kenyan sports bloggers, YouTubers or even former athletes. Their followers trust them for betting tips. Short video content (game analysis, bettor stories) shared on TikTok/Instagram can drive affiliate links naturally.

- Target the Right Audience. Use GEO-targeting to focus on top betting regions (Nairobi, Kisumu, Nakuru). Schedule ads for peak hours (evenings/weekends when people are free). Remove underperforming segments via ongoing analytics.

- Comply Carefully. Stay up-to-date on BCLB rules. Avoid phrases like “bet now!” or using celebrity endorsers. Include required disclaimers (“18+ only”, “Play responsibly”). Consider framing ads as game/site reviews or tutorials to circumvent direct bans. If a campaign is rejected, test alternative wording or focus on gift-like bonuses instead of gambling itself.

- Track and Adapt. Always use conversion tracking. Analyze which sources (search, social, pop, etc.) yield actual sign-ups and deposits. Blacklist ineffective placements and double down on what works. Pivot quickly if regulations change — for example, if Facebook ad rules tighten, shift budget to native ad networks or influencer posts.

888STARZ Partners: Choosing Best Affiliate Program

Running traffic to Kenya can be just as profitable as to Egypt, Nigeria, or any other high-potential Tier-3 market. And as Kenya’s economy continues to grow, it could soon become one of the top GEOs for African betting and gambling offers.

Kenya’s young, tech-savvy population and booming mobile economy make it one of the most attractive GEOs for sports betting and online casino affiliates in 2025. With internet use surging and a passionate betting culture, the market is set for continued expansion. Affiliates who localize their content, leverage mobile channels, and understand Kenya’s unique regulatory environment can generate high ROI.

To capitalize on these trends, consider joining a robust affiliate program — 888STARZ Partners. Our program offers competitive revenue shares (starting at 25% and scaling up to 50% with performance), full support for popular payments (bank cards, crypto, etc.), and marketing materials suited for global traffic in various tiers. By partnering with 888STARZ, affiliates gain a trusted brand and technical support to target Kenyans effectively. Kenya’s iGaming boom is real — now is the time to tap into it. So join 888STARZ Partners today and start directing Kenyan players to one of the fastest-growing gaming platforms on the continent. Let’s make it big in 2025!